How Infrastructure Will Impact Your Ability To Create Capital Growth

This is because one of the key factors to affect the capital growth and rent rate potential of property is infrastructure. Therefore, it is crucial to look at what is going on within the location that you’re planning to buy in.

Infrastructure includes things like transport, schools, roads and hospitals. All of these factors create jobs and income, which in turn puts money in a property investor’s pocket through good rent returns and steady capital growth.

Currently, in Australia, we’re seeing some huge economic moves and changes that will drive infrastructure growth and benefit smart investors who know what to look for.

WHAT IS HAPPENING RIGHT NOW IN AUSTRALIA?

To understand how changes and developments in infrastructure benefits you as a property investor we need to pay attention to what’s happening right now.

In Victoria, the government has pledged $1 billion towards building the southern hemisphere’s largest flu vaccine manufacturing plant near Melbourne Airport, and the 20/21 budget has earmarked $2.2 billion to the Suburban Rail Loop, creating new tunnels and stops that will improve rail travel in the metro areas and beyond.

NSW is investing in infrastructure too, committing $72.2 billion over the next three years to road and rail projects.

Currently, there is a huge amount of government stimulus and investment in infrastructure. While interest rates are at a record low for us as investors, state and federal governments are also taking advantage and borrowing cash to plough back into the economy.

WHY IS INFRASTRUCTURE IMPORTANT TO PROPERTY INVESTORS?

New or improved infrastructure creates jobs, quality housing, and areas of good liveability where people will pay higher rents to live.

Introducing something like a new train or tram line, a Westfield shopping centre, or a new motorway can drive property prices up much faster than everyday capital growth predictions.

And it’s not just the end products that make a difference. The construction projects themselves create jobs. This in turn brings more people into an area and demand for housing goes up, meaning rent rates can also rise.

RECOGNISING OPPORTUNITY WHERE OTHERS DON’T

COVID-19 rattled us. It put our health, jobs and homes in jeopardy, and many people might be scared about making an investment decision at a time when so much is still unknown.

But the truth is that the Australian economy is investing in infrastructure growth, which will help to create jobs, higher incomes and greater wealth.

Buying a property within a 20km radius of new or improving infrastructure projects is a smart, educated investment choice.

COVID-19 has exposed the quality of how people live, and how we want to live in the future. We want green spaces, high mobility, easy access to local areas and walkability to amenities. We want to be close to the action.

Infrastructure developments and improvements can provide the quality of life people are demanding now and in the future.

BUY RIGHT, BUY NOW

With interest rates low and infrastructure projects high, there has never been a better time to buy – however, you still need a strong strategy to ensure you’ll reap the long term rewards of a successful property investor.

Sign up for one of our free information and education events, where you’ll be equipped with the tools, resources and support to thrive, and not fall behind on your path to financial freedom – whatever that may look like for you.

Book your spot now and find out what you need to know about the current market landscape and how you can make it work for the ultimate wealth creation opportunities.

Recent Articles

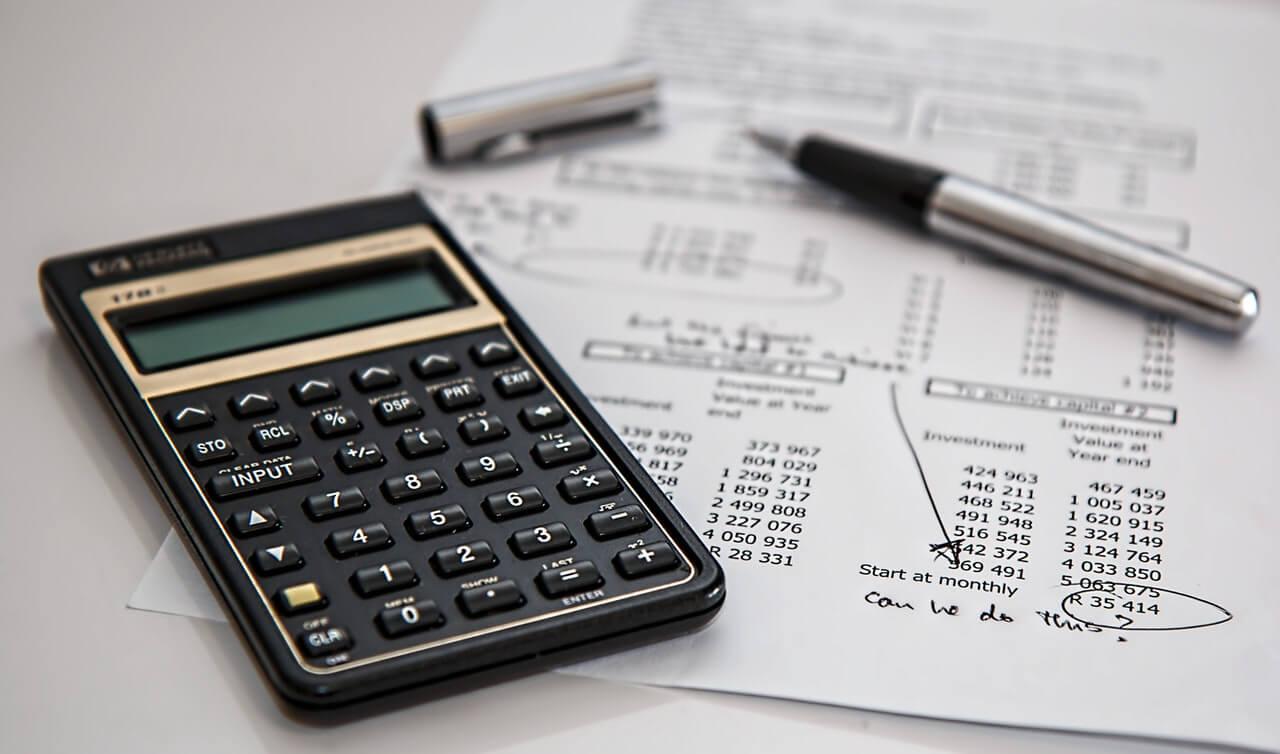

Principle Interest or Interest-Only: Which is better?

Should you structure your property finance as principal interest or interest only?

The reality is, there’s no one size-fits-all, especially when you’re a property investor and your needs are unlikely to be the same as a single-home owner.

In saying that, your finance set-up is critical to get right, and could make a major difference in your long-term ability to create wealth.

Here’s the basics to help get you started.

Property investing: Five ways to create cashflow boom!

When it comes to property investment there are some things you can never have enough of.

When it comes to property investment there are some things you can never have enough of. Good tenants, reliable builders, a great relationship with your bank.

But more than anything what you need is good cash flow.

Having a steady income of cash means never having to dip into your own pocket to top up repayments, complete repairs or make another purchase.

Here are the top five ways you can ensure the cash keeps flowing, so you can keep your investment portfolio growing.

Lock it in! How to protect your equity

Don’t be caught without it.

As a property investor who is building a portfolio, it’s vital that you have access to your equity whenever you need it.

There’s nothing more frustrating than finding that perfect new property to purchase, only for it to be held up – or worse still, lost completely – because your finances weren’t in good shape.

Having an interest-only loan structure with a healthy off-set account is a great way to ensure you have equity at your fingertips whenever you need it, but that’s not the only way…

Infrastructure that Skyrockets your Property Wealth

You’ve probably heard it before, infrastructure is vital to your property investing success. ...

5 Stress-Saving Tips For Picking the Right Property Manager

Choosing the perfect property manager will ensure that your investment is safe. ...

5 Tips To Find The Best Properties To Invest In, Even In A Downturn

Property is an amazing asset that can grow your wealth over the long term. However, it’s vital...

THE ATO OWNS YOUR MONDAY

I went to work yesterday and earned myself a wage. A pretty standard Australian thing to do, where...

Find Out How Many Properties You Need in 2 Minutes, Even If You’re Not a Math Wizard

It’s a question as a property investor you’ve probably asked yourself.. “How many investment...

4 Ways to Pay Off Your Mortgage Faster Without Pushing Yourself to the Limit.

These 4 tips will help you pay off your mortgage early without straining yourself. Paying off...