A Lending Boom Is Coming Are You Ready?

Tick, tick, BOOM! How to prepare for the lending explosion

Ready…set INVEST!

After a lot of bad news over the past 12 months – thanks a lot COVID-19 – it’s nice to be able to kick off 2021 with some good news. There’s going to be a lending boom which, if you have your property investment strategy in place, is going to make your life a whole lot easier so you can build your property portfolio faster and cheaper.

WHY IS LENDING SO IMPORTANT TO PROPERTY INVESTORS?

Most property investors need to borrow money to be able to invest. High-interest rates can make borrowing cash an expensive thing to do.

But with interest-rates at a record low, and predictions keeping them there for the next few years, suddenly investing in property is more accessible to more people.

WHY IS PROPERTY THE RIGHT HOME FOR MY CASH?

Once upon a time, high deposit rates meant our grandparents could bank their savings and watch the dollar amount go up and up. Those fairy tales died out years ago. Deposit rates are woeful now and having your cash sitting in a bank is pretty worthless.

The property market is a better place for your cash because, when done right, it can generate an income. The more properties, the more income, the better off you are.

BORROW AND BUY – BUT BUY THE RIGHT PROPERTY!

Combined with the lending boom we’re currently in, we also have a supply issue in real estate. Partly due to foreign investment being cut, and repercussions of COVID-19, there is a lack of new builds available.

The danger in this is that with cash being cheap to borrow and lending being a new opportunity for many, people are subject to panic. They don’t want to miss out on the lending boom, so they buy an over-priced property that doesn’t have the liveability factor, the walk score, or the Third Space it needs to be an income generating investment.

In short, don’t just buy anything. The rules of property investment still apply. Buy property close to burgeoning infrastructure, good job opportunities and industry. Buy a property in an area with desirable liveability factors, such as green space and social areas. Buy a style of property that is in demand in the area and buy good quality property that’s been constructed by a developer and builder with good credentials.

GET READY AND GO FOR IT

While we expect to see low interest-rates for some years, the property market is an ever-changing, fluid thing, and things can shift quickly. Don’t just watch this space, get yourself ready to act. Seek out property investing experts, start researching what areas are booming, get your numbers in line and be ready to buy good property and hold it for a long time. This is the time to act and not look back in three to five years and wish you’d bought into the market when you could afford to borrow the cash to do it.

HOW TO ESTABLISH A CLEAR STRATEGY

Talk to the experts at TRC-Gorod, who together have decades of experience, about how to borrow and buy in the current market.

Sign up for one of our information and education events, where you’ll be equipped with the tools, resources and support to thrive, and not fall behind on your path to financial freedom – whatever that may look like for you.

Book your spot now and find out what you need to know about the current market landscape and how you can make it work for the ultimate wealth creation opportunities.

Recent Articles

Principle Interest or Interest-Only: Which is better?

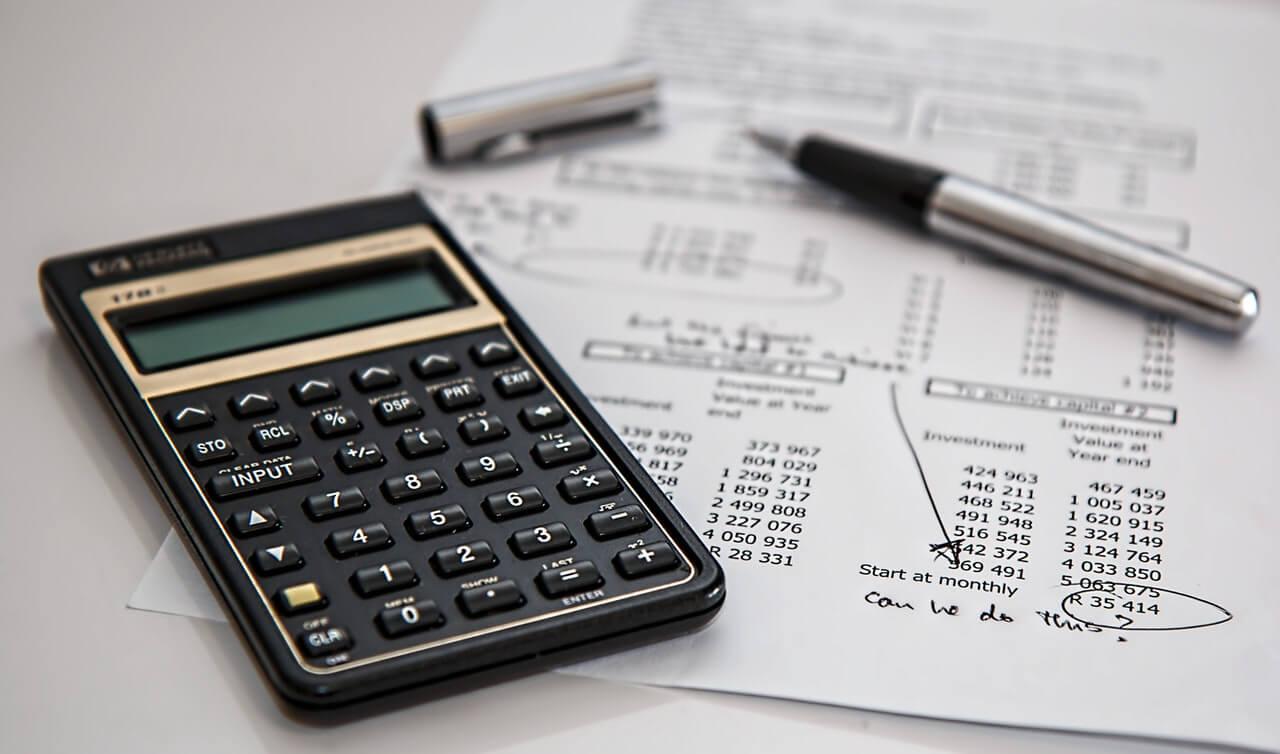

Should you structure your property finance as principal interest or interest only?

The reality is, there’s no one size-fits-all, especially when you’re a property investor and your needs are unlikely to be the same as a single-home owner.

In saying that, your finance set-up is critical to get right, and could make a major difference in your long-term ability to create wealth.

Here’s the basics to help get you started.

Property investing: Five ways to create cashflow boom!

When it comes to property investment there are some things you can never have enough of.

When it comes to property investment there are some things you can never have enough of. Good tenants, reliable builders, a great relationship with your bank.

But more than anything what you need is good cash flow.

Having a steady income of cash means never having to dip into your own pocket to top up repayments, complete repairs or make another purchase.

Here are the top five ways you can ensure the cash keeps flowing, so you can keep your investment portfolio growing.

Lock it in! How to protect your equity

Don’t be caught without it.

As a property investor who is building a portfolio, it’s vital that you have access to your equity whenever you need it.

There’s nothing more frustrating than finding that perfect new property to purchase, only for it to be held up – or worse still, lost completely – because your finances weren’t in good shape.

Having an interest-only loan structure with a healthy off-set account is a great way to ensure you have equity at your fingertips whenever you need it, but that’s not the only way…

Infrastructure that Skyrockets your Property Wealth

You’ve probably heard it before, infrastructure is vital to your property investing success. ...

5 Stress-Saving Tips For Picking the Right Property Manager

Choosing the perfect property manager will ensure that your investment is safe. ...

5 Tips To Find The Best Properties To Invest In, Even In A Downturn

Property is an amazing asset that can grow your wealth over the long term. However, it’s vital...

THE ATO OWNS YOUR MONDAY

I went to work yesterday and earned myself a wage. A pretty standard Australian thing to do, where...

Find Out How Many Properties You Need in 2 Minutes, Even If You’re Not a Math Wizard

It’s a question as a property investor you’ve probably asked yourself.. “How many investment...

4 Ways to Pay Off Your Mortgage Faster Without Pushing Yourself to the Limit.

These 4 tips will help you pay off your mortgage early without straining yourself. Paying off...