Whether you’re in need of help with planning your taxes, paying for your children’s education, estate planning, or many other milestones in life, a financial planner can help.

He will take a look at your circumstances and help you devise strategies you can use to reach your goals – tips you might have missed somewhere along the way.

When you add a financial planner to your team of property professionals you’ll be amazed at what can happen.

Following is a list of just some of the services that most financial planners provide:

- Cash flow management

- Debt management/reduction

- Insurances

- Investments

- Mortgage repayments

- Retirement

- Savings plan

- Superannuation

- Tax planning

Your financial planner should provide you with clear, actionable steps for any recommendations he provides.

He should also advise you of any risks or weaknesses in the plan.

What to expect

These questions are designed to narrow down what he will do for you, and how your own beliefs and habits surrounding finance impact your decisions.

Following are just some examples of what your financial planner might ask when evaluating your particular situation.

Expect many more questions, depending upon your answers and your circumstances:

- If money was of no concern, what would you do with your life?

- What is important about money?

- What do you do with yours?

- How much debt do you have? How does this make you feel?

- How would you feel if your investments took a dip for a period of time? What if it was for several years?

- What is more important to you as an investor; keeping as much principal as possible or making a profit on your principal?

- Would you be willing to sacrifice some of the security from your investments in return for long term growth?

- What do you like to spend money on?

- What impact, if any, has the way you acquired money had on how you feel (or think) about it?

- What are the top 3 things you want to do most with your money?

- What does your retirement look like? What do you want it to look like?

- Do you have kids? Do you plan to have any?

- Do you plan to pay for your kid’s education or do you want them to pay for some or all of it?

- What do your insurances look like? Do you have health and life insurance and if so, how much?

- Do you envision taking care of your parents at some point in the future? If so, how would that look?

How you can help your financial planner help you

For example, sit down and put together an accounting of your financial situation.

Write out a list of:

- What you own – home, investment property, savings, super, etc. (your assets)

- Your liabilities – mortgages, loans, credit cards, etc.

- Your expenses and your income

- Your insurance(s), including policy amounts

- Status of your estate planning (e.g. will, trusts, etc)

Documentation to take with you:

- Copies of your payslip

- Account statements – checking, savings, super, etc.

Think about…

What you want to accomplish.

Do you want to retire early? Start your own business? Add to (or start) your property investment portfolio?

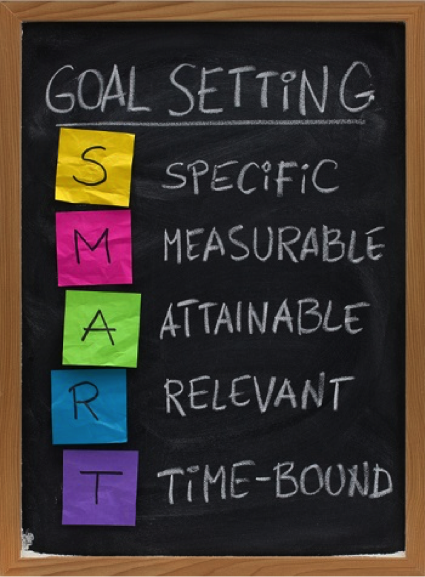

Make a quick a list of your goals; include as much detail as possible, such as a rough timeframe of when you want to reach them.

Also, think about what kind of advice you’re looking for. Do you want a general overview or are you want advice in a particular area such as property investing and/or retirement?

When you find a great team; property mentor, broker, agent, financial planner and more you’re stacking the odds ever better in your favour that you’ll create the lifestyle that might have escaped you thus far.